Why title insurance is essential to secure, affordable homeownership

The Federal Reserve’s decision this month to cut its benchmark interest rate by 25 basis points was encouraging news for Americans eager to become homeowners. Although mortgage rates aren’t set by the Fed, they are impacted by its policy changes. Indeed, prior to — and in anticipation of — the Fed’s

Read MoreClosing Costs Unpacked: State-by-State Breakdowns for Today’s Buyers

If you’re planning to buy a home this year, there’s one expense you can’t afford to overlook: closing costs. Almost every buyer knows they exist, but not that many know exactly what they cover, or how different they can be based on where you’re buying. So, let’s break them down. What Are Closing Cos

Read More6 Things Real Estate Agents Say You Should Always Fix Before Selling Your Home

Selling your home is a big move. It is not only a financial decision but also an emotional one. It may be hard to imagine that future buyers won't appreciate design features that you find charming, but the reality is that it’s a buyer’s positive first impressions that will sell your home fast. That’

Read More-

Selling a home as-is can be a strategic decision for many homeowners.This option often appeals to those who want to avoid the costs of repairsafter negotiations, homeowners with limited equity, or those facing financialchallenges. It can also set clear expectations that buyers should conducttheir du

Read More What is a Down Payment Gift and Who Can Give it?

When it comes to buying a home, one of the most significant hurdles many first-time buyers face is the down payment. However, a down payment gift can alleviate some of that burden. Understanding what a down payment gift is and who can provide one can make the home-buying process more accessible. Wha

Read MoreHomebuyers Gear Up for a Mortgage Rate Drop This Fall: What To Know as the Housing Market Shifts

Homebuyers who are gearing up to shop for a house this fall might wonder whether the mortgage rate gods will smile in their favor. They’re right to ponder: Last October, rates hit a 23-year high of 7.79% for a 30-year fixed home loan, according to Freddie Mac. Since then, rates have plunged to 6.47%

Read MoreHow Affordability and Remote Work Are Changing Where People Live

There’s an interesting trend happening in the housing market. People are increasingly moving to more affordable areas, and remote or hybrid work is helping them do it. Consider Moving to a More Affordable Area Today’s high mortgage rates combined with continually rising home prices mean it’s tough f

Read MoreCreate An Old Money Look For Your Home

Timeless Elegance – Creating an “Old Money” Look for your Home There is a certain look and feel that just oozes “old money.” These homesare graceful and elegant with interiors that are timeless and beautiful. Farfrom changing with each trend, these homes offer a sense of history that iswarm and in

Read MoreDoes That Come With The House?

When touring a beautifully staged home, it's easy to admire both the layout and the furnishings. While certain furniture like sectional sofas may seem perfect for the space, they typically don't stay with the home once sold. However, the inclusion of other items in the sale might not be so clear-cut

Read MoreBasics and Importance of Title Insurance

Title insurance is a critical component of the home selling process, yetmany homeowners do not fully understand what it is or its value. Simplystated, title insurance protects both buyer and seller from any potentialissues with the property’s title. When selling a home, obtaining titleinsurance offe

Read More-

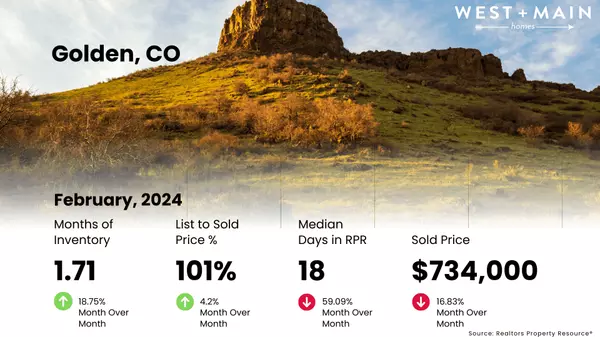

When looking at the real estate metrics provided, we can see a correlation between the Months Supply of Inventory, the 12-Month Change in Months of Inventory, the Median Days Homes are On the Market, the List to Sold Price Percentage, and the Median Sold Price. The Months Supply of Inventory being a

Read More Weekly mortgage demand jumps again as interest rates fall just below 7%

Mortgage rates swung slightly lower last week, fueling a significant jump in mortgage demand for the second straight week. Total application volume rose 7.1%, compared with the previous week, according to the Mortgage Bankers Association’s seasonally adjusted index. The average contract interest rat

Read More6 Ways to Create a Beautiful Spring Garden

What could be more welcome than the first warm breezes of spring? They refresh both the gardener and the garden. There’s no better way to enjoy this change in the weather than to plan your borders so they peak during this beautiful time of year. Spring starts anywhere from February to April, dependi

Read MoreChange the Feel of Your Room for $500 or Less

Everyone is looking for easy ways to spruce up their home. As springapproaches, those warm, cozy rooms that were so inviting in the cold canlook cluttered and dark. If redecorating every season isn’t in your budget –and how many people can – then consider adding or changing a rug or twofor big impac

Read More-

Selling a home in the best of situations can be stressful; adding in a divorceand selling a home can seem impossible. It’s an emotional time for thewhole family and this can cause you to make the wrong decisions in thesales process. In addition to finding the right real estate agent, whounderstands

Read More -

Home Search Frustration? How to Refocus and Keep Going The best part of buying a new home is going out and touring homes. This isespecially true for first-time home buyers. As time goes on, however, it canbe frustrating when each home falls short of expectations. While it’simportant to be realistic

Read More New Home Loan Limits Announced

As home prices continue to rise, consumers are getting a break from theFederal Housing Administration who regulates the loan limits forconforming and government guaranteed loan programs. Home loans are categorized into government guaranteed, conforming, andjumbo lending products. As the name suggest

Read More-

Limit Disruptions During the Holiday Showings Selling your home during the holidays requires a balance between familycelebrations and public access. While your home may look its best, it canbe challenging to accommodate the last-minute showings. Communicationwith your agent is critical and with p

Read More Should You Repair or Replace a Roof?

One of the most important elements of any home is the roof. The roof is thefirst line of defense in protecting the home from weather-related issues,such as wind, fire, and rain. Over time, the constant abuse can take its toll,and your roof will require some attention. But how do you know if youshoul

Read More-

There is nothing more frustrating for a seller than to watch houses aroundthem sell like hot cakes while theirs lingers on the market. Finally, when thelisting expires, they find themselves asking why? Why didn’t my house sell?In a robust housing market like we’ve had the past few years, the goodnew

Read More

Categories

Recent Posts